Are you an extreme coupon clipper? How’s that working out? Maybe pretty good, you’re saving money. Or maybe you’re spending to save. Or maybe it takes way too much time and you abandoned this strategy for living with fewer expenses.

Well, forget about it. If you want to know how to achieve the American dream, follow the lessons of the Fatzinger family. Learn from the “Einstein of economical.”

“These days, frugality is not about clipping coupons. It’s about rethinking your finances, and maybe your life. …

‘Spend money on what makes you truly happy and on what you enjoy.'”

That’s the message from Rob Fatzinger, the patriarch of a family with 13 kids that lives outside of Washington, D.C. What’s remarkable about them isn’t so much that the family focuses on its happiness rather than on its possessions, but that it is living debt-free in one of the most expensive suburbs in the country.

TPOH doesn’t know what spur recently jabbed The Washington Post to begin covering positive new stories, like the recent one about a Republican mayor helping the poor, or the Fatzingers, a model in the pursuit of happiness. But in a world of media errors, it doesn’t matter why. It just matters that the news is good and … useful.

In the case of the Fatizingers, the story is of a devout Catholic family, led by husband and wife, Rob and Sam, who took frugality to a whole new level. The lessons are ones we can all take home to our smaller households.

Back in 2000, they bought a five-bedroom house out of foreclosure and later added three bedrooms. Nine children, including the youngest, who is 4, live there now.

The good news: The home cost $150,000. The Fatzingers paid down $50,000, saving interest on the 15-year mortgage.

The bad news: Sam said their priest, visiting to bless the new home, ‘walked in and said: “Should I do an exorcism on this house?”‘ The place was in serious disrepair.

‘Relatives gutted it and made it livable,’ Sam said. ‘Youth groups were over here, ripping up carpet, taking down walls.’ Someone gave them a wood stove. A relative gifted them a used couch. Later, another couch was left on a curb for anyone to take. Score. …

The family shops at sales or secondhand stores and checks out the Freecycle Network, a site for giving away belongings.

Friends and strangers also chip in. ‘We always have someone dropping off a bike,’ Sam said. ‘We would get things and not even know where they came from.’ …

These days, even the childless can be terrified of college costs, so just imagine having 13 kids. But the Fatzingers have a strategy, and it’s working. The plan: Start in community college, don’t expect a handout from Mom and Dad, and graduate debt-free.

So far, Alexandria, the oldest at 26, graduated at 21 with a master’s degree in social work. Joshua, 25, graduated from the University of Maryland with a degree in kinesiology and became a missionary.

Caleb, 23, is in the last year of a doctoral program in physical therapy at the University of Maryland at Baltimore. And Lizzie, 21, graduated in May from the University of Maryland with a math major, while also cleaning houses and tutoring. All four graduated from college debt-free.”

Now, this family has made sacrifices. It had a failed business. Caleb is now living off a loan to finish his doctorate. The kids work multiple jobs and really long hours. They skip over the latest must-have Nike sneakers.

But so what? As economist Mark Perry points out, being super frugal doesn’t feel like deprivation, and it isn’t so hard in today’s America.

According to data from the Department of Agriculture, aggregate spending on food in the US has been below 10% of disposable personal income in every year since 2000, compared to an average food share of nearly 19% of personal income in the 1950s and 15% in the 1960s. …

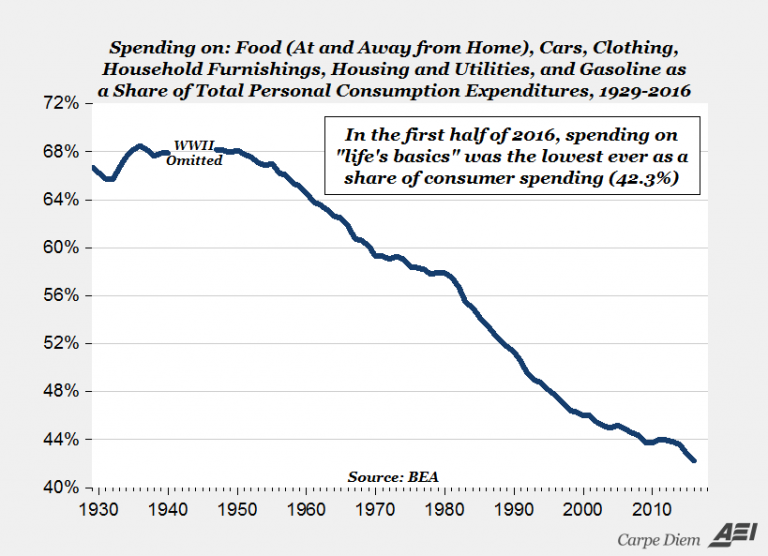

In the first half of 2016, Americans collectively spent only $1 out of every $3 of disposable (after-tax) personal income on ‘life’s basics’ – the lowest share in history. Up until the early 1960s, American spent more than half of disposable income on ‘food, shelter and clothing;’ and that share didn’t fall below 40% until 1991. The increased affordability of manufactured durable goods like home appliances, furniture, electronic goods, and cars, along with increasingly competitive prices for food, clothing and energy have brought the share of spending on life’s basics to the lowest level ever in recent years. …

Spending on ‘energy goods and services’ as a share of total consumer spending fell below 4% of total consumer expenditures during the six months of 2016 for the first time since the BEA started collecting data back in 1929. That means that energy affordability (‘energy frugality’) has been greater in the first half of this year, when measured by energy spending as a share of total consumer spending, than at any time in US history.

Perry includes a chart to make visualizing frugality in America a little easier.

So, if you’re willing to “live small,” in other words, use second-hand merchandise, buy at discount stores, save money, and avoid debt, you can live the American dream, even in 2016 in a house of 15 people and a strong commitment to succeed by everyone in the family.